INVESTOR OPPORTUNITY

INVESTOR OPPORTUNITY

India is the world’s fourth-largest carbon emitter with its population of 1.3 billion people with the power sector contributing majorly to the same. 293 global and domestic companies have committed to generating 266 GW of solar, wind, mini hydel and biomass-based power in India over the next decade. This initiative would entail an investment of $310 billion-$350 billion. International Finance Corporation (the investment arm of the World Bank Group) is planning to invest about $6 billion by 2022 in several sustainable and renewable energy programs in India. The Indian power sector has an investment potential of Rs 15 trillion over the next four to five years, which indicates immense opportunities in power generation, distribution, transmission and equipment. (2 GW) are now in India.

Strong tenders expected in PSU, Government, C&I. More than 25 GW of tenders expected and 20 GW of Residential Opportunity

Investments into clean energy in India rose 22% in the first half of 2018 compared to the same period last year, while investments by China fell 15%. At this rate, India is expected to overtake China and become the largest growth market by the late 2020s. India has been eyeing the pole position in the clean energy transformation, looking to have at least 175,000 megawatts (MW) of installed renewable energy capacity by 2022. 100% FDI is allowed under the automatic route for renewable energy generation and distribution projects subject to provisions of The Electricity Act, 2003.

World’s largest solar plant (648 MW), commissioned within a record 8 months, and the world’s largest solar park (2 GW) is now in India.

INVESTMENT RATIONALE

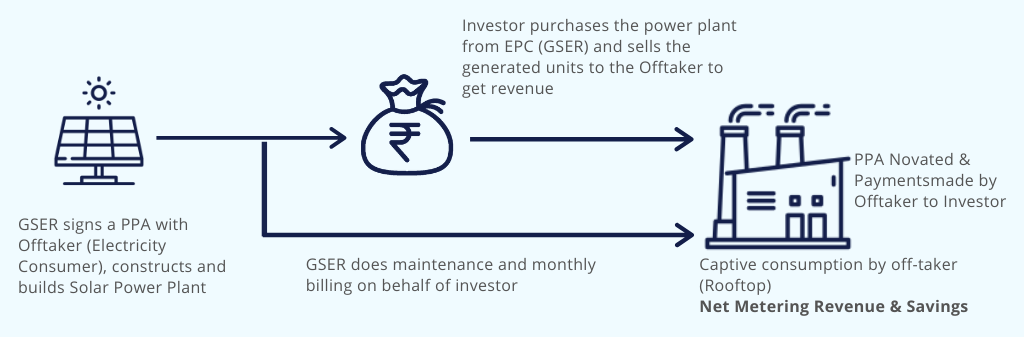

TYPICAL INVESTMENT

| Individual Project Investment | Project Level IRR with AD* | Equity IRR with AD* | ||

|---|---|---|---|---|

| Post-tax | Pre-tax | Post-tax | Pre-tax | |

| Unlevered Returns | 11-13% | 16-19% | NA | |

| Levered Returns | 13-15% | 17-20% | 18-30% | 30-50% |

| Typical Project Payback Period | Project payback 6-8 years | |||

*AD : Accelerated Depreciation

*Figures are indicative and based on 35.7% taxation

| Other Financial Structure | ||

|---|---|---|

| Typical Size of Investment | 1-10 Cr (small ticket investors) Investment size : 2000kw-2MW |

5-50 Cr (Non AD Regular Large Ticket Investors) Investment Size : 1 MW - 10 MW |

| Typical Finance Structure | Equity Participation : 20-100% | Loan Participation : 0-80% |

Debt assumed between 9 – 10.5%

(Several PSU banks have a solar mandate)